A quick follow up on the unfolding commercial office space disaster...the news isn't good

Office vacancy rates continue to climb and that's a bad thing for a $3.2T asset class

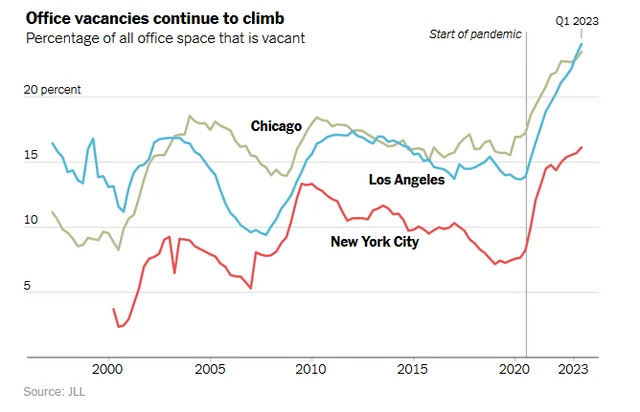

Office vacancy rates hit record highs in NYC, LA, and Chicago in Q1 of 2023, showing this is problem continuing to get worse, not better.

As pointed out by a friend, over $2T worth of office space debt will be up for refinancing before 2025, probably at rates over 10%. Banks will require significantly more equity from borrowers on properties where their value has decreased significantly. As he put it, “the owners will just hand over the keys.”

The likelihood of a catastrophic destruction of wealth is very high.

Happy mother’s day.