The Finance Industry is a Useless Drain on The Economy that Should be Made Illegal

The quiet story of the most powerful and profitable monopoly in the world

My father told me something one of his law school professors told him when he was a kid:

Attorneys, unlike almost any other occupation, do not create any intrinsic value. They facilitate the flow of it. A smart attorney will hold the money for a brief moment, take some out, and then pass it along.

As a corporate finance attorney, he made a good living doing this. Now, I highly value good attorneys since the secure flow of capital is necessary to a functioning economy.

However, the magnitude of profits in the finance industry are something else entirely.

From M&A, to IPOs, to payments, banks suck capital out of people and companies alike for themselves. The two most profitable areas of income for banks are overdraft fees and payments.

Overdraft fees are pure evil, especially with the way many banks implement them. I once traveled in college, made 6 charges in a day, and overdraft my checking account by $0.24. I was hit with six $35 fees for a total of $210. Now just to get back in the green, I had to pay an enormous fee for a minuscule mistake.

Overdraft fees are an enormous burden on the poor in this country as they are the ones almost always hit by them. It’s a disgusting regressive tax on the poor and they should be outlawed. Why was my card not just declined when my account would have gone negative? Turns out to this day, most banks won’t even let you set up your account to decline if you overdraft, they are so ruthless to get fees.

But payments…woah boy. I once had a SVP from Wells Fargo tell me that when they break out their internal P&L by business segment, payment fees made up 40% of their profits.

It’s one of those things that is not frequently discussed. Every time you make a transaction with a credit card (not so much debit cards anymore after Durbin), a fee of around 2-3% is taken from the merchant. This is why you see gas stations with a cash price different from card. Interestingly, card service agreements generally make it against the agreement to have a cash vs. credit price and doing so will mean you can no longer accept cards.

The credit card mafia is run by VISA and MasterCard, which for all intents and purposes might as well be the same company. See if you can name any differences between the two. They work in concert to keep fees high and prevent anyone from getting into the industry. These fees are collectively referred to as “interchange fees.”

Now, who benefits? Well, some go to Visa and Mastercard. But almost all goes to the bank that issued you the card. They make more off these fees than the interest on credit cards. It’s essentially a tax to do business in the US.

When I first noticed this and how ancient the technology is, I decided to start a 0% fee competitor. Our business would instead rely upon deep POS integration to get in-receipt data (i.e. what you are buying) so we could sell it for marketing purposes. (For reference, VISA and MC at the time did not get this data although marketers pay top dollar for it…that has somewhat changed over time as they find more and more ways to collect it).

I approached a very prominent Nashville Investor, he took one look, locked eyes with me and said something dead serious I’ll never forget:

If you start this, you’ll end up dead

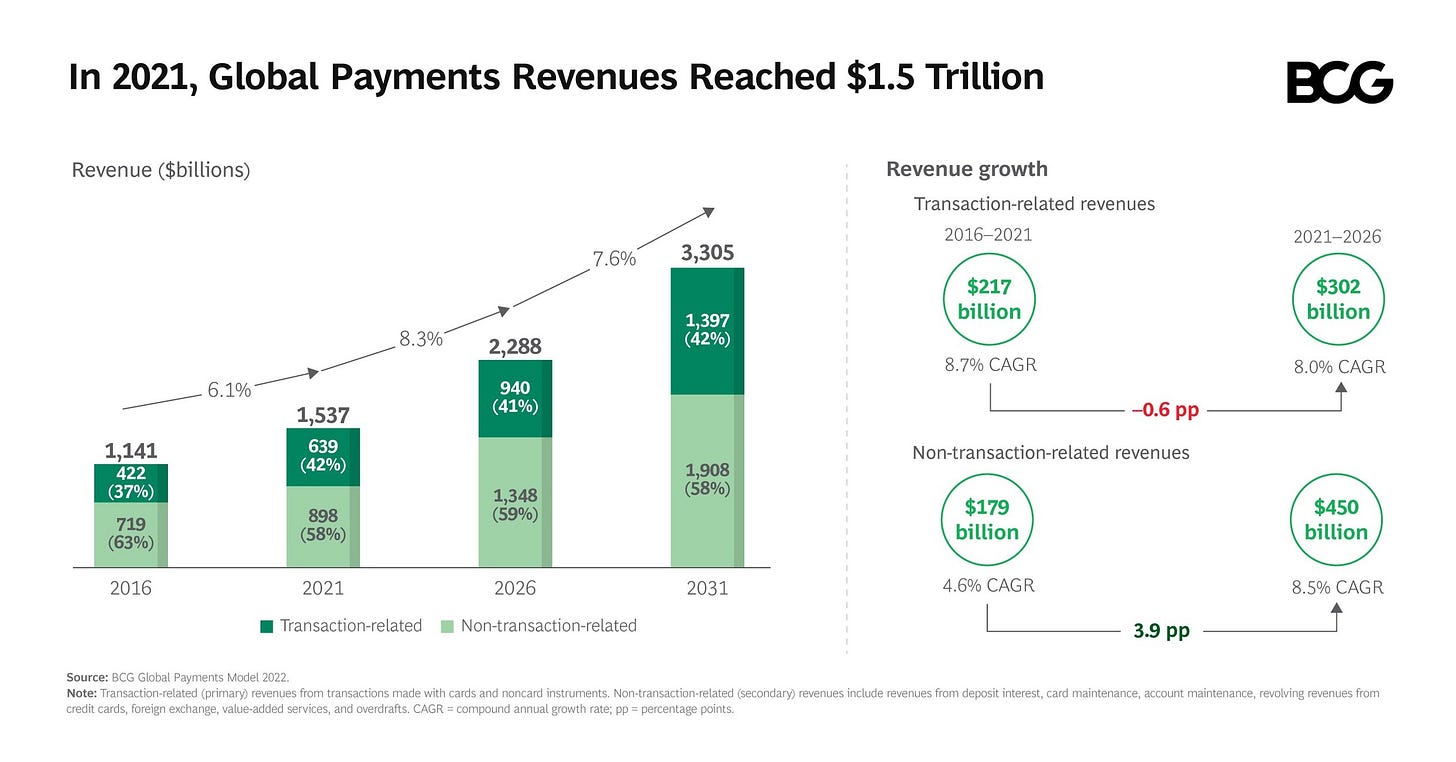

In 2021, transaction related fees amounted to $1.5 trillion. Just from that little 2-3%.

This is the biggest scam in America. There is essentially no cost associated with processing transactions and these fees are tantamount to pure theft from merchants. That’s why there has been no rival to Visa and Mastercard…do you really want to threaten $1.5 trillion of income for banks?

Let me give you a hint. When I was CEO of Omnivore, I had my life credibly threatened for some of the business I was doing. In the end, I had to give the person what they wanted in order to not potentially get murdered.

If you don’t think the rich and powerful kill people with impunity, think again because I’ve lived through it. So do corporations. And $1.5 trillion is a lot of money.

Similarly, banks suck up all the brightest minds in the US to find clever ways to trade or make deals that are wildly profitable. Are these people helping society in any way? Are they designing new technology? Are they inventing things? Heck, even starting companies? No. You can make way more money as a programmer finding out how to speed up an HFT transaction by 0.0001 second than you ever will in any other industry.

Between payments and their brain drain on society, banks are a disgusting succubus draining the economy of capital. And of course, they entrench themselves so much as that if they ever make a wrong move, the US Taxpayers themselves will bail them out.

Look at SVB. They took inappropriate risks with their capital and went under. Yet rather than only $250,000 being protected, the entire balances of every account were made whole. Recent reports said that most of this money did not actually go to the small business it was purported to protect, but large, politically connected Venture Capital firms and corporations with balances of over $1 billion or more at risk.

Right now, we are watching in slow motion as commercial real estate enters a dark period. I have it on good authority that the Fed is already buying up non-performing loans from regional banks quietly in order to prevent a collapse of the banking sector.

So, how does any of this benefit society?

It doesn’t. At all. It benefits a tiny fraction of the wealthy and powerful. This is one of their biggest sources of income. Banking is ridiculously profitable. It’s why I worked in FinTech and started a payments company. The closer you are to a lot of money moving, the easier it is to make a lot of money by taking a tiny piece.

There is simply no justification for the existence of interchange fees anymore given modern technology. Banks recently settled a class action against collusion and their ridiculous rules to the tune of $5.6 billion:

The settlement resolved claims that Visa and MasterCard overcharged retailers on interchange fees, or swipe fees, when shoppers used credit or debit cards, and barred retailers from directing customers toward cheaper means of payment.

To them, that’s just a speed bump. There is so much money, almost all of which is profit, made from interchange fees that it eclipses the entire size of most of the world’s largest companies. Think about it. Banks make enough every year from these fees they could buy Google or Amazon. Every year.

This is the quiet secret to to the largest and most profitable monopoly in the world where most of the wealth for select few is generated. And now you know. The question is, what are we going to do about it?

Thanks for publishing this info. How long can this go on for? Sadly already too long...

From what I can see in their annual report Wells Fargo made $4 billion on card fees out of a total of $74 billion in revenue, so roughly 5%. Still a lot but not the primary revenue driver by any means.

Which is not to say it's not a giant ripoff - it is. Credit card companies are basically monopolies sanctioned for historic reasons which are well due to be disrupted, as I'm sure they will be.

If you want to really take a look a ripoffs in the financial space, consider the oligopolistic US IPO market, which on average charges double compared to Europe.