"The Mass Extinction Event for startups is under way"

This is pretty dire news

According to IVP’s Tom Loverro, who wrote a long twitter thread explaining how a mass extinction event for startups is underway, things are looking pretty dire in the startup world. And he seems to have a point.

In 2021, startups raised a record amount of capital. Lots of companies that should never have been funded were. In general, they raised about 2 years worth of runway. They’ve been working hard to extend it, but they’re all going to have to raise in H2 2023 or early 2024. According to Loverro, “4 in 5 very early-stage companies have fewer than 12 months of runway.”

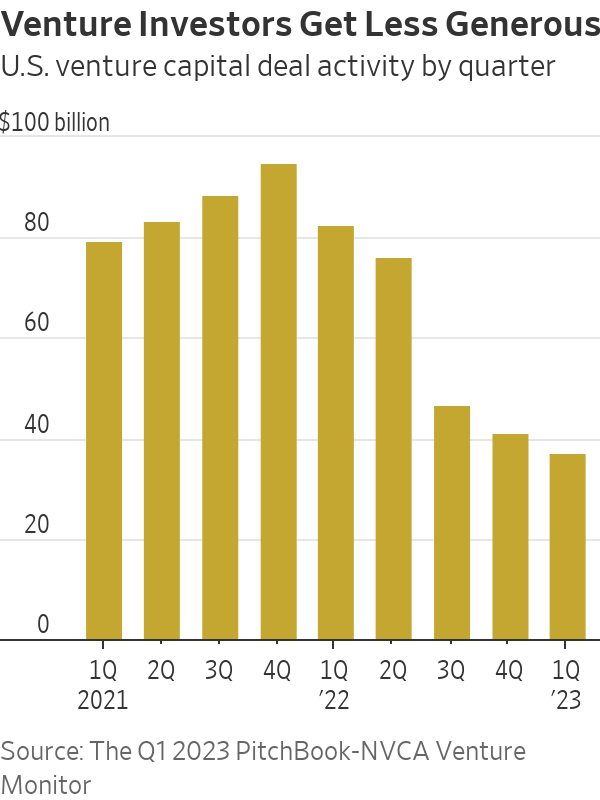

This is a problem. VC activity has gone off a cliff as their LPs are hesitant to put money into risky investments in this high interest rate environment when they can put it elsewhere with much less risk and similar returns.

If you want to read more about why VCs are on the sidelines, I’ve previously written about it:

We all hear stories about how there is a lot of “dry powder” on the sidelines, but the fact is a lot of that has already been used up to participate in pro-rata rounds and give. out bridge notes to existing portfolio companies. There’s simply not enough capital for all of these companies to raise successfully.

And to be fair, nor should they. Much like a forest fire, clearing out underperforming startups will lead to a healthier ecosystem in the long run. But over the short term, it appears there will be a lot of cheap aqui-hires and bankruptcies quietly buried, unlike the same company’s Series A announcement heralded on TechCrunch.

The good news is companies with growing revenue, product/market fit, and a strong business model will be tended to, as they are the ones that provide the actual returns for VC funds. None of the companies that fail were probably ever going to produce a return anyways so while it’s going to be painful, especially for startup employees being laid off into an already abysmal job market, we shouldn’t see VC returns fall too much.

If you are a founder or CEO, the twitter thread has some good advice on what you should be doing now to survive.

Now how long will this last? There’s no telling. Probably until interest rates come way down. Until then, LPs will continue to put onerous demands on every VC investment and VCs will be hesitant to call on them for capital. I also cannot imagine a worse time for a VC firm to raise a new fund, right when it’s needed the most.

As the annals of history have told and retold the story, death and rebirth is an unending cycle. And it appears we’re about to enter a long winter for startups.

I wish you all the best of luck.